We've always prioritized privacy and security, following the National Bank’s guidelines closely. In the past, this approach compromised some user journey optimization. However, the evolution of open banking and PSD2 has provided us with more freedom to make changes. With updated market standards and regulatory requirements, we are excited to introduce a new Ponto onboarding flow that simplifies and accelerates the process of linking users' bank accounts. All this while remaining true to our values.

A transparent but optimized PSD2 user journey

Users want to seamlessly connect bank information with software applications, such as bookkeeping solutions. However, the connection between the bank and an open banking provider is regulated by PSD2. And the data shared between the open banking provider and the software application is regulated by privacy laws such as GDPR.

In short, the user must authorize both his bank and the open banking provider. These elements add more steps to the process. This inspired us to redesign a more efficient but transparent user onboarding flow which offers seven key aspects:

1. Less steps with pre-filled data

When a user links a bank account for the first time, Ponto allows partners to create an “onboarding resource”. This API can be used by software vendors to pre-fill the required data with known information such as official name, email address, mobile phone number, etc.

In addition, when the software already knows a user’s bank account, the bank can be pre-selected. This shortcut eliminates the need to add a bank selection screen to Ponto.

Check out: how to create onboarding details

2. Minimized Data Collection

When Ponto was launched, Open Banking was an unfamiliar concept, and the risks were unclear. As a precaution, we followed Belgium’s National Bank requirements and implemented a strict Know-Your-Business (KYB) process for onboardings. However, we identified that this was redundant because users complete extensive Secure Customer Authentication (SCA) and KYB at their banks.

To remove this friction, we minimized the data required for sign-ups to just three fields:

- Organization name,

- valid VAT-number,

- and email address.

With our updated onboarding, we've taken things one step further by optionally prefilling this data, allowing users to sign up even faster!

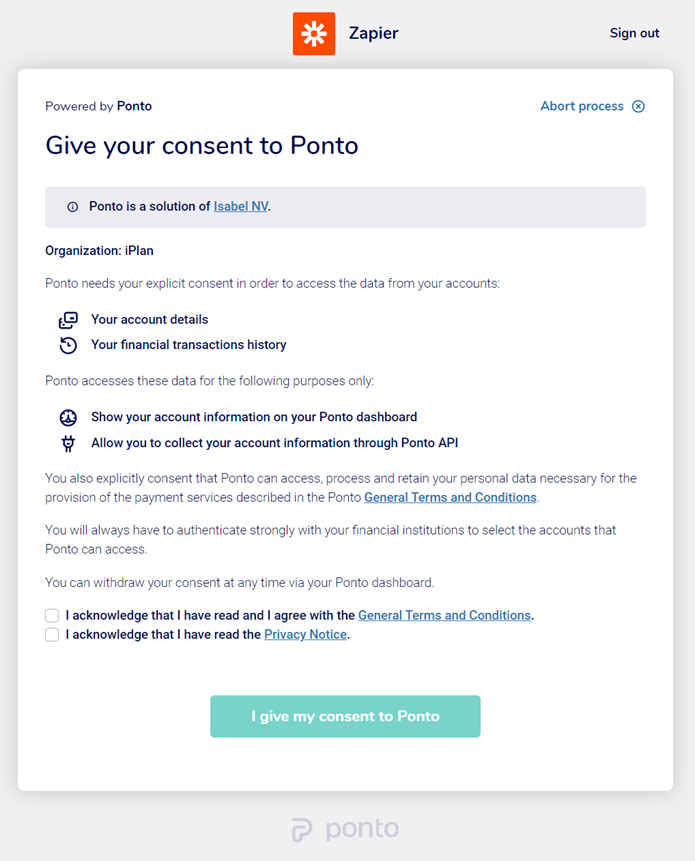

3. Simplified Consent

We combined the acceptance of the General Terms and Conditions with the Privacy Notice Policy and explained on a single page what the user consented to. Before, those policies were separate steps.

Additionally, we removed the requirement to confirm Ponto’s account (now optional).

New consent page

4. Ponto’s portal became optional

As cited above, registering for Ponto's portal is no longer required. However, it is still available to users interested in Ponto's Graphical User Interface (GUI). This allows users to either:

- Manage their bank account connection from the software application, without logging into Ponto.

- Or open a Ponto account to manage connections and authorizations within Ponto's portal. This is useful when the user wishes to connect his bank account to multiple partners.

By no longer requiring an active Ponto account, users can re-authorize their connections without logging in to Ponto. Previously, this could result in issues and friction, for example when users forgot their password.

5. Ponto’s account creation became optional

It is no longer mandatory to create a Ponto account, instead we just verify the email, allowing partners to:

- Onboard a customer who has not activated his Ponto portal through a six-digit verification code received by email. Note: New customers will receive this verification code.

- Or redirect a customer who activated their Ponto portal.

6. No more account deletions

Users under the Customer Paying Model no longer have their connections deleted due to missing information. Before, this could lead to software synchronization issues. We now temporarily disable accounts if we don’t have all the required data after two weeks. Completing the missing information reactivates the connection without data loss.

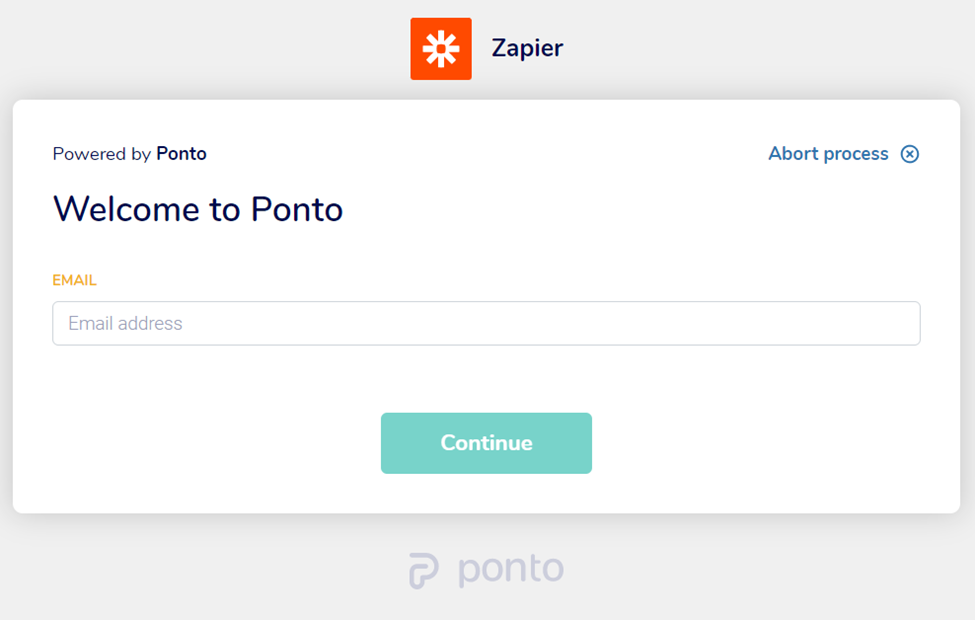

7. Customization

We have also redesigned the Ponto pages with the partner logo featured more prominently. This ensures a more consistent flow from the partner via Ponto to the bank.

Customized onboarding page with partner’s logo.

Finally, Ponto's new onboarding flow simplifies and accelerates connecting users’ bank accounts. The updated flow offers pre-filled data, minimized data collection, simplified consent, and customization, among other elements. These changes provide a more efficient and transparent user journey that complies with PSD2 and privacy laws.

TLDR:

Ponto’s revamped onboarding flow simplifies linking users’ bank accounts by:

- Including less steps to activate the integration with pre-filled data.

- Offering faster consent management.

- Reducing friction between Ponto and the software application allowing the partner to customize the screens with their logo.

- Making Ponto’s portal optional only for users who need it to manage multiple tenants.