Despite all the challenges introduced by Open Banking and unstable API connections, Ibanity has always maintained its core values and mission, helping partners transform the way they interact with bank data through innovation and customer centricity.

Through this approach, we've made great strides allowing us to expand our products at a European level. Today, Ponto is connected to 1,800 banks in Europe and serves over 150 partners with harmonized Account Information and Payment Initiation APIs.

We're committed to continue closing the gaps in bank connectivity and business automation. We're excited to announce Ponto for Representatives, a new feature dedicated to automating financial data input in any software!

Bank Connections Can Be Established in Different Ways Depending on the Use Case

Throughout our journey, we've served multiple industries and learned that not every Open Banking use case is the same. Here’s why:

Open Banking is ultimately about being able to retrieve transaction information for Account Information (AIS) in an automated and structured manner. However, the way the data is used and the preferred method of connecting, authorizing, and maintaining bank connections differs from one case to the other.

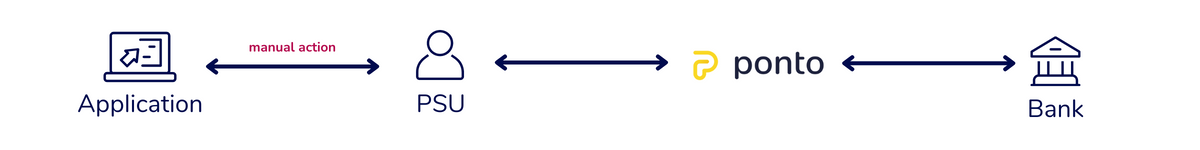

When Ponto was launched back in 2019, the Payment Service User (PSU) or bank account holder was directed to Ponto’s website, where he created an account and authorized the connection between Ponto and the bank account. From Ponto’s portal, the user could create Ponto tokens to share with his favorite applications. The applications use the tokens to access Ponto and retrieve the desired data.

Through this method, Ponto interacts with the bank and the applications interact with Ponto. We still offer this integration under the label “Custom Integrations”. This method is used primarily by offline or on-premises solutions. The setup works well but it still requires some user interaction, which was the reason Ponto Connect was developed.

Custom Integrations

Ponto Connect allows the application to follow a more user-friendly redirect model to set up the connection. As part of the Ponto Connect flow, the PSU is sent directly from his application to Ponto, where he authorizes the bank connection and integration with the requesting application. The token is shared with the application using the OAuth protocol, so no further user interaction is required. Most of Ponto's integrations today rely on this safe and user-friendly method.

Ponto Connect

.png?width=1200&height=150&name=Bank%20(1).png)

Despite the success of Ponto Connect and Custom Integrations, we noticed that these two options did not cover every use case.

A Solution for the PSU Without Direct Access to the Application

At Ponto, we serve multiple software solutions including online, cloud based, offline and on-premise. However, a third scenario, where the PSU does not have access to the requesting application was missing!

Very often, accountants are faced with this last scenario. Let us explain this further:

Typically, an accountant uses his preferred bookkeeping software and does the administration on his client’s behalf. To get the transaction data, the client must:

- Manually download the data from his internet banking and periodically sent it to the accountant.

- Or, initiate a lengthy and often complicated process to provide the accountant with a bank mandate.

Both of these processes require a lot of manual labor and zero added value. Innovation and customer-centricity are at the heart of what we do. That is why, we have created Ponto for Representatives, a tool to help accountants reduce manual work, eliminate bank mandates and automate their business processes!

Ponto for Representatives, a Solution That Offers Accountants Automation of Financial Data in Any Software

Ponto for Representatives

.png?width=1200&height=250&name=CFO%20(2).png)

With Ponto for Representatives, the accountant can link his preferred software to his client’s bank accounts without setting up a bank mandate. The link allows the accountant to automatically retrieve the transaction information of the client’s bank accounts and keep the administration up to date in real-time without action needed from the bank account holder.

How does it work?

- The accountant signs up to Ponto as a Representative.

- Within Ponto's environment, the accountant creates authorization requests (URLs) and sends these requests to his clients (e.g. via email).

- The accountant’s clients click the link and open Ponto, where they can connect their bank account and authorize the accountant to retrieve the payment data.

- The accountant can view their customer’s bank accounts in Ponto and link the accounts to his preferred software solution using Ponto Connect or a custom integration with Ponto tokens.

Ponto for Representatives Adapts to Multiple Business Needs

Ponto for Representatives serves use cases where the PSU does not have direct access to the requesting application and would like to grant a Representative access to their bank account data in a secure, user-friendly and controlled way.

This is applicable in a variety of scenarios including:

- Accountancy: Accountants often need to have the bank transaction data to complete their administrative duties, but not all accountants share their software access with their clients. With Ponto for Representatives, clients can give accountants a secure access to their bank account data in an easy way.

- Real Estate: Owners of rented real estate sometimes make use of management companies for maintaining their property. This includes administrative duties. To verify the rent payments for example, these management companies need access to the property owners bank account data. Using Ponto for Representatives, this use case can be enabled in a controlled way.

- Audits: Auditors need access to their client’s bank account for auditing purposes. With Ponto for Representatives, auditees can easily give a one-time access to auditors without the need to request complicated bank mandates or fraud-sensitive manual processes.

These and many other use cases are now supported by Ponto for Representatives. The bank account holder remains in full control over:

- Who has access to his bank account,

- For how long,

- And, what they can see and do.

Do you have a use case that would benefit from Ponto for Representative? Reach out for more information!

.png)