A Simpler and Faster Onboarding Process for Ponto's Customers

We've always prioritized privacy and security, following the National Bank’s guidelines closely. In the past, this approach compromised some user journey optimization. However, the evolution of open...

Read more

10/05/2023

How to Connect No-Code Platform Zapier and Ponto Open Banking APIs

Unlock the full potential of your bank data by automating your workflows. Easily connect your bank accounts with Ponto to over 5,000 apps in Zapier. And the best part? You don't need to be a...

Read more

30/03/2023

PSD3: What to Expect?

In May 2022, the EU Commission launched three consultations on changes to the Second Payment Services Directive, also known as PSD2, and a planned regulatory framework for Open Finance.

Read more

15/03/2023

Ponto for Representatives, a New Way to Provide Accountants Controlled Access to Their Customers’ Bank Accounts

Despite all the challenges introduced by Open Banking and unstable API connections, Ibanity has always maintained its core values and mission, helping partners transform the way they interact with...

Read more

28/11/2022

Isabel Group Proud Sponsor of Fintech R: Evolution Crossroads

Isabel Group will partner with Fintech France for their biggest annual event "Fintech R: Evolution CrossRoads" on October 20, 2022 in Paris.

Read more

17/10/2022

Ponto Announces Partnership With WeFact, a Dutch Invoicing Solution for Online Administrative Tasks

As the invoicing market grows, Ponto continues to gain popularity among international accounting software solutions. Thanks to Ponto's stable and secure API connections to 1,800 European banks, the...

Read more

24/08/2022

Five Wishes for Open Finance, Banking and PSD2

We are almost celebrating the three years anniversary of PSD2. When it was first introduced, it made many promises for our industry. These promises included more innovative services and more...

Read more

18/08/2022

Reverse engineering banking apps, an introduction to alternative account access

PSD2 is now a reality. Following its introduction, most Fintech companies now use banks' dedicated interfaces to connect with customers' payment accounts. But that doesn’t mean that techniques prior...

Read more

27/06/2022

How Can Banks Monetize APIs and PSD2 Services?

Almost fifteen years ago, the first Payment Services Directive came into effect. As a result, the ecosystem was harmonized, innovation improved, security was enhanced, and consumer data was...

Read more

19/05/2022

Our PSD2 journey

It's September 2019, let's go! The world of Open Banking starts today! Every fintech registered as a PSD2 Third-Party Provider (TPP) will be able to consume customers' banking data much more easily...

Read more

03/12/2021

Unboxing TLS, OpenSSL, key pairs and certificates

You probably all know about the "https" prefix on a website, right? And it's somehow obvious to you that it represents secured and encrypted communication between your browser and the website that...

Read more

01/10/2021

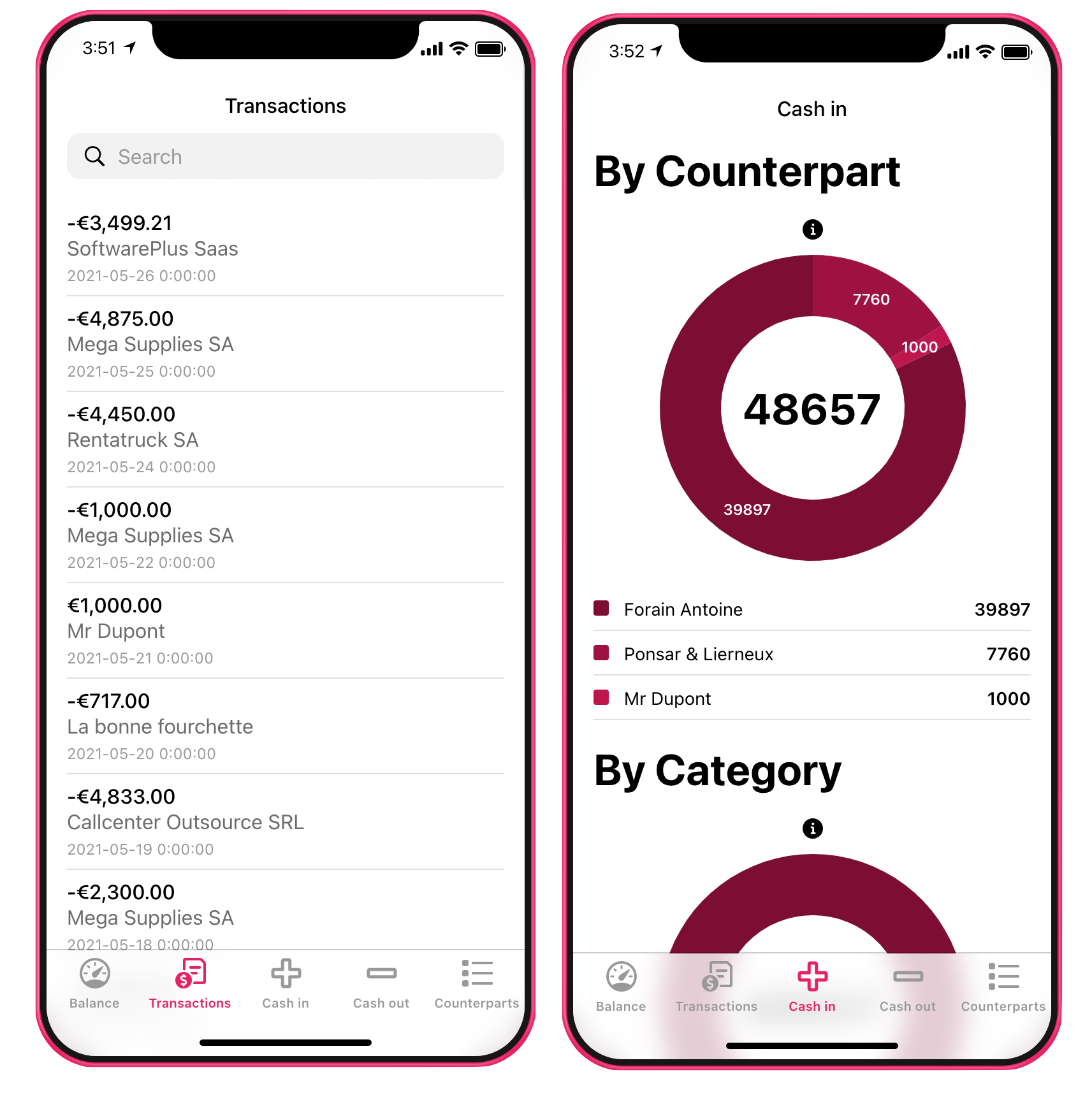

A basic business banking app with no code tools thanks to PSD2 and Glide 🚀

Recent regulation changes in the banking industry are making it possible to connect to your bank accounts from multiple services thanks to APIs. Next to that, more and more online tools allow you to...

Read more

10/06/2021

Automating bank authentication with Digibot

The Ibanity team works to make accessing and integrating banking data quick and painless. With our XS2A product, we provide one clear API to access account information and initiate payment requests...

Read more

12/03/2021

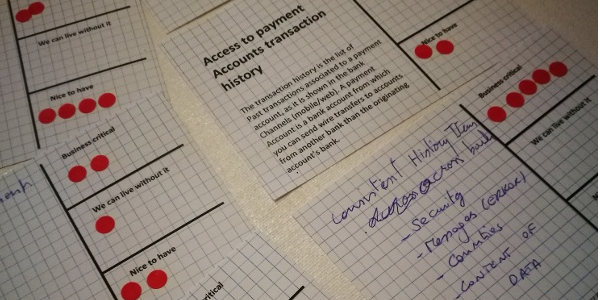

Open banking 1 workshop

Two weeks ago, we held our first "Open banking" workshop together with Fintech Belgium and hosted by Buy Way. It followed 2 "TPP workshops" where we analysed the expectations of the Belgian TPPs and...

Read more

30/09/2019

Belgian bank PSD2 API list

The September 14 deadline is already behind us as the banks keep working on their APIs. How are the Belgian banks currently doing? Do they have sandboxes, specs or live APIs? We have collected all...

Read more

25/04/2019

March 14, an important PSD2 milestone but what if banks miss it?

Today is an exciting day in most of the European banks as on this day they have to make a sandbox available to third party providers to start testing the banks' dedicated interface, for example an...

Read more

14/03/2019

Co-signing of corporate payments: new PSD2 channel

How do mandate management and co-signing look in the context of the new PSD2 XS2A channel? Following our previous blog post on the current status of co-signing, we are looking towards the future....

Read more

25/01/2019

What do fintechs want in PSD2 / open banking?

The first step to better collaboration In light of PSD2, many new business opportunities arise for both fintechs and incumbents, individually or together. To improve the collaboration between both...

Read more

11/01/2019

Co-signing of corporate payments: current situation

We started with an introduction post and we start the new year with clarifying a couple of concepts. Terminology around co-signing is not always used in the same way. So let’s first of all clear cut...

Read more

03/01/2019

Co-signing of corporate payments: introduction

The revised Payment Service Directive (PSD2) requires banks to open their platforms and give third parties access to the (payment) accounts of their mutual customers: PSD2 XS2A – read as access to...

Read more

13/12/2018

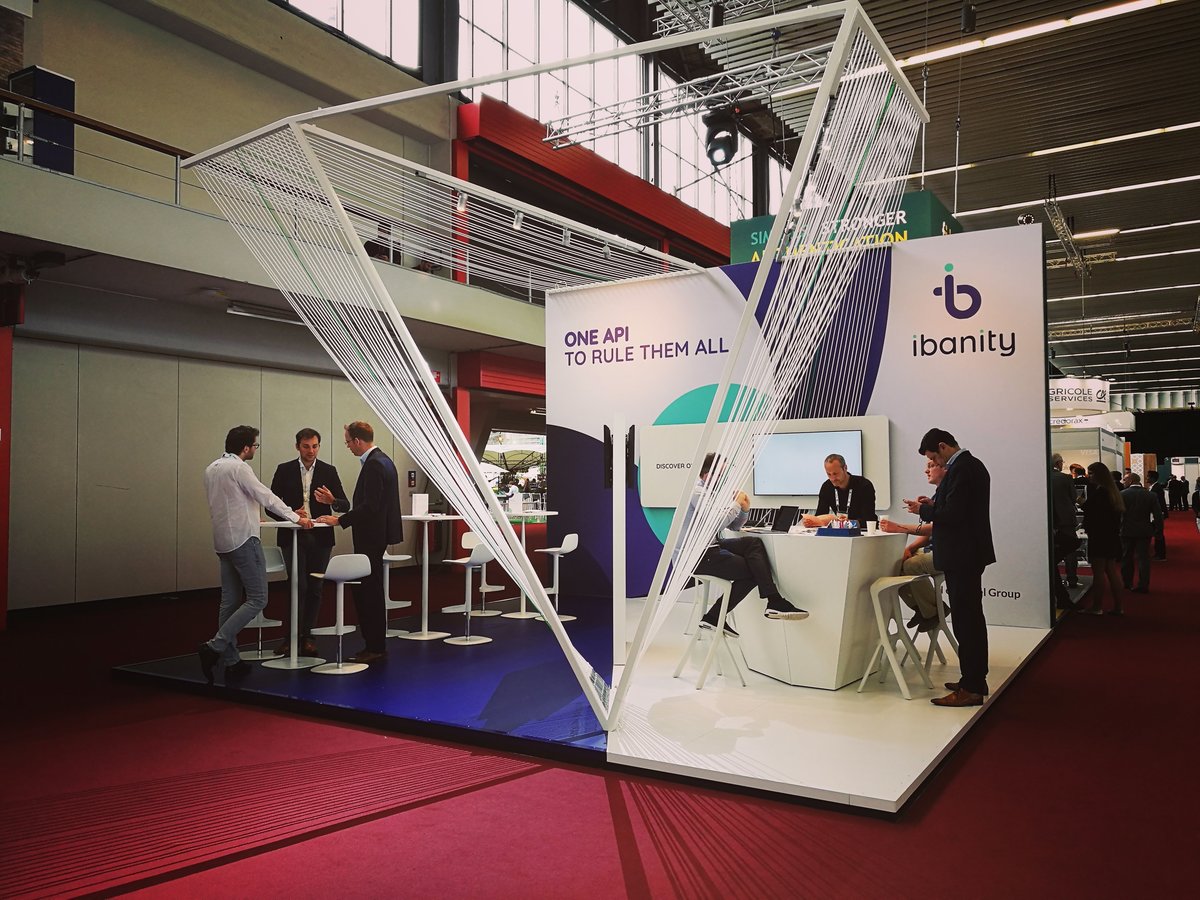

Building bridges on Money 20/20

With over 6000 attendees, Money20/20 is the biggest financial services conference in Europe. It was the first time for Ibanity and Isabel Group to have a stand at this huge get-together of fintech...

Read more

03/07/2018

How FinTech-friendly is PSD2?

The new Payment Service Directive 2 (PSD2) challenges the emerging FinTech sector. What are the real struggles for FinTechs and how should they deal with them?

Read more

29/05/2018

Matching fintechs and banks for the future of banking

In the context of open banking and the PSD2 regulation, Ibanity builds a bridge between fintechs and banks. Bringing the two worlds together in order to co-create has several advantages for both...

Read more

29/05/2018

4 reasons why API aggregators are the key to PSD2 success

An API aggregator (also referred to as “API Hub”) is an API on top of several different APIs. It provides a single point of implementation and delivers a unique and standardized API regardless of...

Read more

24/04/2018

.png)

.png)

.png)

-1.png)

.png)

.png)

.jpg)

.jpg)