Two weeks ago, we held our first "Open banking" workshop together with Fintech Belgium and hosted by Buy Way. It followed 2 "TPP workshops" where we analysed the expectations of the Belgian TPPs and Fintechs regarding PSD2 and Open Banking. You can find the reports of those two previous sessions on this blog.

OB... What?

For the Open banking 1 workshop, or in short "OB1", we couldn't resist to turn it into a Star Wars themed workshop and started with a little gimmick.

A new banking hope. That was the headline of our session. Ok, we added a bit of drama to our intro to set the mood. But it expresses what we believe is currently happening in the banking sector with PSD2 and open banking: new opportunities to create and deliver meaningful services to consumers and companies.

But we didn't want to limit ourselves to banking services. That's why we invited communities such as Startups.be and #BeTech, the Belgian startup ecosystems, to bring a non-financial startup audience and see what we could come up with combining non-financial platforms and financial platforms together. We got more than 50 participants to collaborate during an evening and we had a blast!

The process

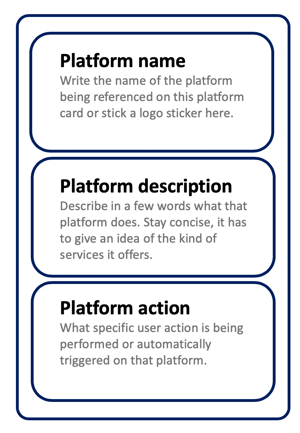

Of course, you can't just put 50 people in a room and just expect something to happen... So we prepared the workshop and created a little collaboration activity. The first item is the "platform card". It is meant to capture one specific capability of a platform. For instance a bank can be seen as a platform which offers traditional banking products and one of the specific features or action is to offer a mortgage loan.

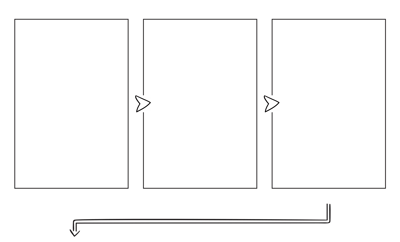

Participants were separated in groups of 4 or 5 from diverse backgrounds and were asked to prepare as many of those "platform cards" they could think of that were linked to their own products and services. The cards ranged from banking services to payment recovery services but also went to image recognition services and companies matching services. Once we had a diverse set of platform cards, we asked the audience to start combining them together and fill the gaps by adding the missing platforms they would need to build their new combined customer journeys.

In order to show the newly created customer journeys, we came prepared with stackable customer journey maps printed on A3 sheets of paper.

Once each group had finished at least one customer journey, and between Yoda or Chewbacca impressions from the audience, each group presented their creation to the room which then gave feedback and voted for it using a simple show of hands thanks to the "fist of five" technique.

We were gladly surprised by the customer journeys the group provided. Here are a couple of examples:

- Apartment renting services within real estate platforms: renting an apartment can require a lot of administrative tasks. Getting guarantees, verified identity information, proof of income, propose renter's insurance, etc... The idea was to combine banking services and real estate services and include the banking information needed in the process directly in the real estate platform so that the landlord could consult or receive a "renter's rating" for any potential candidates and make the process easier for both the renter and the landlord.

- Travel financial assistant: when travelling, it is quite difficult to manage all the different payments and proof of payments. The idea is to include all the financial information about your trip within you banking app and to be able to check what is still unpaid, what is paid, provide a split of how you spent your money during your trip to provide better visibility.

There were several other customer journeys presented. We cannot cover them all in this blog post and the goal was not to come up with the killer app in a one hour workshop but we were pleasantly surprised that some of those journeys would probably deserve a little bit more digging.

Conclusion

Our objective was to show that collaboration between banks and startups is not hard to ignite. We just need to find a structured process to spark a discussion and put ourselves in the shoes of our customers. From the feedback we received, there was a lot of enthusiasm around the workshop and we hope to enable our Fintech Belgium community to collaborate more in the future.

PSD2 and open banking bring a lot of uncertainty in the industry, and to be honest, we are today quite far from the promises of PSD2 when we look at the readiness of the industry and how it is currently implemented at European level. But what is certain is that it's changing the mindset of all players, including, of course, banks. We are very glad to be a part of this new evolution and to help our community move forward.

It's time to stop talking and start doing.