PSD3: What to Expect?

In May 2022, the EU Commission launched three consultations on changes to the Second Payment Services Directive, also known as PSD2, and a planned regulatory framework for Open Finance.

Read more

15/03/2023

Five Wishes for Open Finance, Banking and PSD2

We are almost celebrating the three years anniversary of PSD2. When it was first introduced, it made many promises for our industry. These promises included more innovative services and more...

Read more

18/08/2022

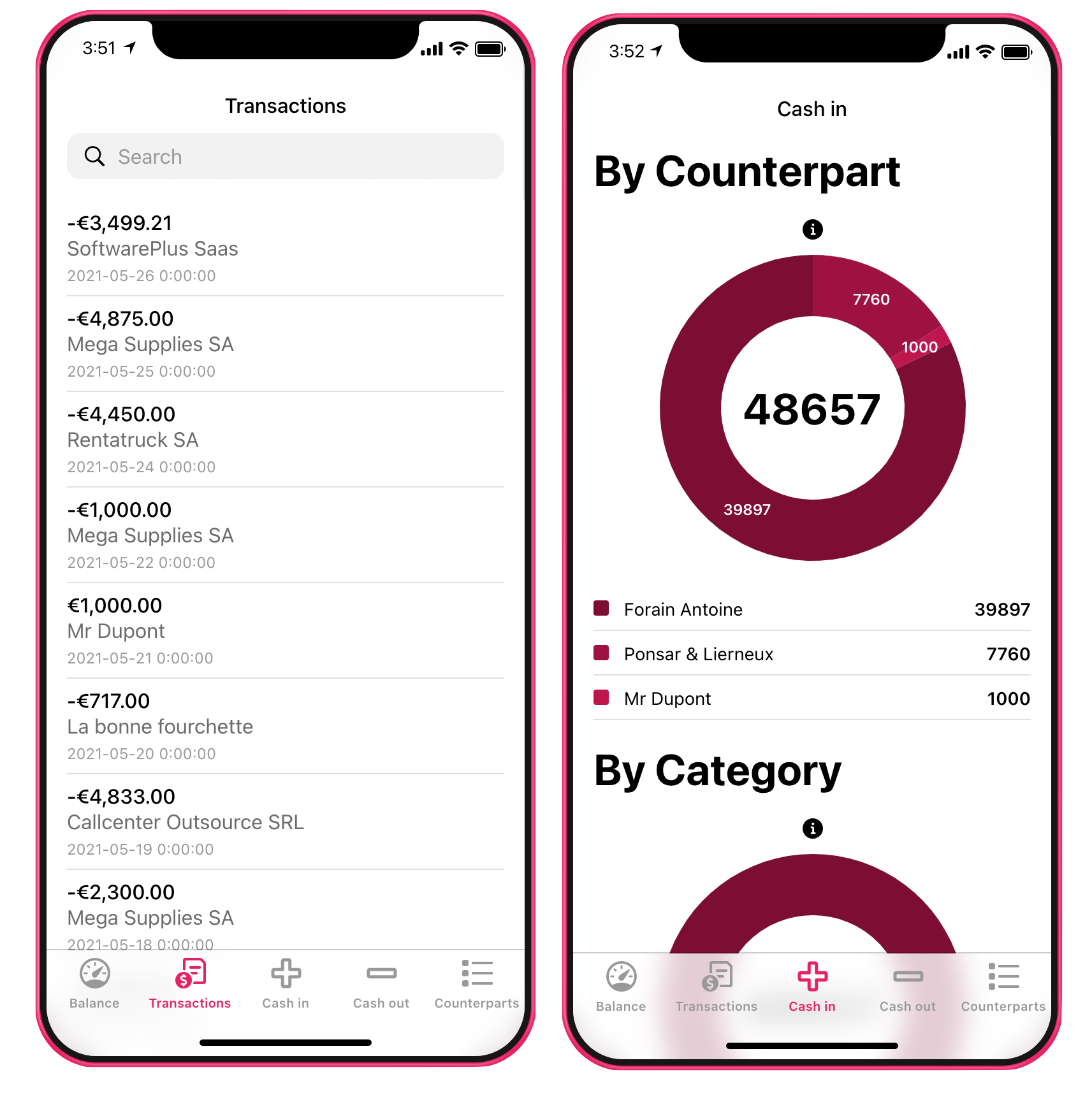

A basic business banking app with no code tools thanks to PSD2 and Glide 🚀

Recent regulation changes in the banking industry are making it possible to connect to your bank accounts from multiple services thanks to APIs. Next to that, more and more online tools allow you to...

Read more

10/06/2021

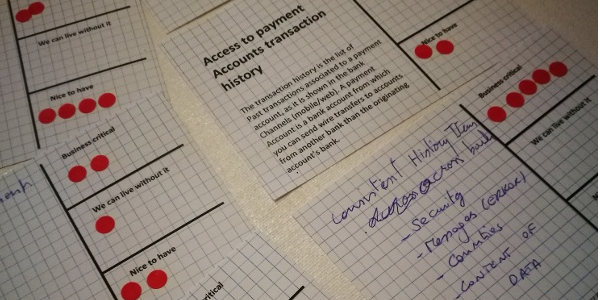

Open banking 1 workshop

Two weeks ago, we held our first "Open banking" workshop together with Fintech Belgium and hosted by Buy Way. It followed 2 "TPP workshops" where we analysed the expectations of the Belgian TPPs and...

Read more

30/09/2019

March 14, an important PSD2 milestone but what if banks miss it?

Today is an exciting day in most of the European banks as on this day they have to make a sandbox available to third party providers to start testing the banks' dedicated interface, for example an...

Read more

14/03/2019

Co-signing of corporate payments: new PSD2 channel

How do mandate management and co-signing look in the context of the new PSD2 XS2A channel? Following our previous blog post on the current status of co-signing, we are looking towards the future....

Read more

25/01/2019

What do fintechs want in PSD2 / open banking?

The first step to better collaboration In light of PSD2, many new business opportunities arise for both fintechs and incumbents, individually or together. To improve the collaboration between both...

Read more

11/01/2019

Co-signing of corporate payments: current situation

We started with an introduction post and we start the new year with clarifying a couple of concepts. Terminology around co-signing is not always used in the same way. So let’s first of all clear cut...

Read more

03/01/2019

Co-signing of corporate payments: introduction

The revised Payment Service Directive (PSD2) requires banks to open their platforms and give third parties access to the (payment) accounts of their mutual customers: PSD2 XS2A – read as access to...

Read more

13/12/2018

Matching fintechs and banks for the future of banking

In the context of open banking and the PSD2 regulation, Ibanity builds a bridge between fintechs and banks. Bringing the two worlds together in order to co-create has several advantages for both...

Read more

29/05/2018

4 reasons why API aggregators are the key to PSD2 success

An API aggregator (also referred to as “API Hub”) is an API on top of several different APIs. It provides a single point of implementation and delivers a unique and standardized API regardless of...

Read more

24/04/2018

.png)

.png)

.jpg)