The first step to better collaboration

In light of PSD2, many new business opportunities arise for both fintechs and incumbents, individually or together. To improve the collaboration between both parties, we organized a fintech workshop “Opportunities in PSD2 / open banking”.

In this workshop we collaborated to identify the TPP's (third party provider) business needs concerning PSD2 / open banking. We then communicated these needs to the Belgian banks at a round table organized by Febelfin to make sure these business needs are taken into account.

Why is this important for the Belgian ecosystem?

As part of Isabel Group we are in continuous contact with all the stakeholders in the Belgian fintech ecosystem, whether it's fintechs, banks, regulators or fintech networks. When we talk to fintechs, one of their main concerns is that they want to collaborate with Belgian banks but they don’t know how to approach them and get the right people at the table. While banks are asking for feedback of the fintechs to better understand their needs and wants but they don’t know where to find them and how to contact them.

Fintech networks, such as Fintech Belgium or Febelfin, generally represent just one of the stakeholders in this ecosystem. They want to improve collaboration but they are sometimes missing the right contacts. So we took it upon ourselves to connect the pieces of the puzzle and help them connect banks, regulator and fintechs.

Results of the PSD2 / open banking workshop

In partnership with Fintech Belgium, we gathered 10 regulated and non-regulated TPP’s (Monizze, Ibanfirst, Digiteal, Topcompare, Twikey, Fluen, Dino, Exthand, Travelex, Pay-nxt) to discuss their business needs. We let them write down different needs around 3 topics: SCA & signature, TPP onboarding, API & data. They could then vote on each business need if it is “business critical”, “nice to have”, “can live without it”. We will show you the top business needs from each category. You can download the full raw results below.

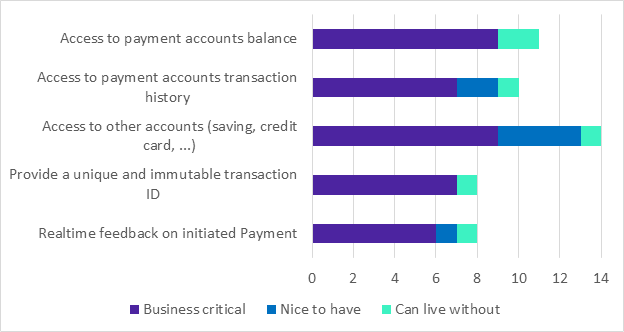

API & data

Access to payment accounts balance: The available balance of a payment account, as it is shown in the bank channel (web/mobile).

Access to payment accounts transaction history: The transaction history is the list of past transactions associated to a payment account, as it is shown in the bank channel (mobile/web). A payment account is a bank account from which you can send wire transfers to accounts from another bank than the originating account's bank

Access to other accounts: Alignment on European level is wanted by the TPP's.

Provide a unique and immutable identifier for each transaction that can also be found in the account history: Each transaction should have a unique and immutable identifier for future reference.

Real-time feedback on initiated payment: When a payment is initiated at the bank, an immediate feedback is needed in order to know if the transfer of funds will actually happen

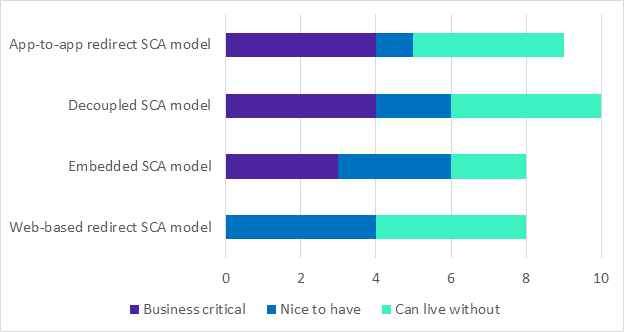

SCA & Sign

App-to-app redirect authentication: When authenticating, customers of a bank are redirected to the bank app to complete the authentication. Once finished, they are redirected to the originating app.

Decoupled authentication: When authenticating, customers of a bank are redirected to a third party identity provider (eg. Itsme) to complete the authentication process. They are then redirected back to the originating app or website.

API-based authentication (embedded): When authenticating, customers of a bank must enter their bank credentials in the interface of the service they wish to use, which will then transfer them to the bank to complete the authentication. The user never leaves the service's interface.

Web-based redirect authentication: When authenticating, customers of a bank are redirected to the bank website to complete the authentication. Once finished, they are redirected to the originating app or website.

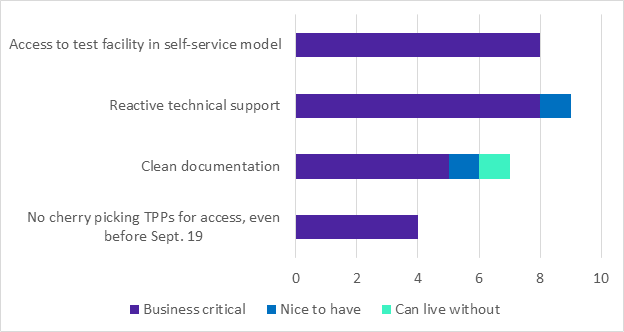

TPP onboarding

Access to test facility in self-service mode: In order to be able to test the bank API, an automated and simple onboarding is available, not requiring any human interaction with a bank staff member.

Reactive technical support: In order to benefit the most from the API, proper support needs to be available during at least business hours.

Clean documentation: In order to understand how the API works, an easy to read documentation is necessary.

No cherry picking TPPs, even before September 2019: TPP's are afraid banks will be cherry picking as soon as their APIs are there, not giving the same chances to all TPP's

So what’s next?

Because our workshop just contained a sample of the Belgian fintech community, will we organize a bigger workshop in the same format in Q1 2019 so we can gather even more feedback. The current results have been communicated to the Belgian banks and we will continue to do so. If you are interested as a TPP / fintech to participate, you can send a mail to Stijn.vanhaute@ibanity.com to receive an invitation for the next workshop.